Translytical Databases Hit the Ground Running

The push for operational analytics that seeks to eliminate the requirement for constantly moving data between storage and databases to support transaction and analytical workloads is fueling the growth of translytical data platforms. The framework uses a single data tier that can serve both transactional and analytical workloads.

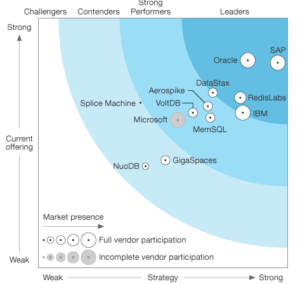

The requirement to reduce data movement between data silos and technology stacks along with rise of machine learning and streaming analytics has fueled the rise of a maturing translytical data platform sector. Market watcher Forrester released a market survey earlier this month that identifies and ranks a dozen key players in the nascent analytics sector.

The market researcher also identified the top translytical database workloads, including: real-time applications; Internet of Things (IoT) analytics operational data; connected data apps; and continuous learning in which translytical databases are used to train and retrain machine learning models.

“The translytical data platform market is growing because more enterprise architecture pros see translytical as critical for their enterprise data strategy,” Forrester said.

The analyst identified five early leaders in the translytical market. In rank order, they are SAP, Oracle, Redis Labs, IBM and DataStax, which is based on the Apache Cassandra. Chasing these market leaders, by rank, are Aerospike, MemSQL, VoltDB, Microsoft, Splice Machine, Gigaspaces and NuoDB.

Top-ranked SAP (NYSE: SAP) was lauded for the ability of its HANA in-memory data platform to handle workloads ranging from real-time applications to translytical apps. “SAP’s translytical platform might be overkill for organizations that don’t have large translytical requirements because some enterprise buyers perceive it to be more expensive than less capable solutions,” Forrester said.

Oracle’s (NYSE: ORCL) in-memory database was cited for its ability to support both transactions and analytics in the same database. Redis Labs was credited with wringing maximum capability from open source platforms to support translytical workloads.

Meanwhile, IBM (NYSE: IBM) was credited with multiple translytical database platforms that take an in-memory, columnar approach while using data compression techniques to reduce storage requirements, Forrester noted. DataStax’s enterprise platform based on Apache Cassandra also embeds Apache Spark to natively support operational analytics. The DataStax platform also supports IoT, transactional and “extreme-scale” applications, the market research reported.

Forrester’s list of “strong performers” included Aerospike, which recently released a new version of its NoSQL database that adds an option to prioritize data consistency. The vendor’s key-value store combines DRAM and flash storage to boost performance over disk-based databases.

Leading applications for the Aerospike database include “fraud detection, real-time bidding, personalized web portals, e-commerce search, and context-driven applications,” Forrester reported.

The market researcher judged the MemSQL database to be a “viable translytical platform” with full ACID (atomicity, consistency, isolation, durability) compliance and sufficient performance to support analytical, operational and transactional workloads.

Further down the list, VoltDB’s in-memory database combines streaming analytics with transactions in a single platform while Microsoft’s (NASDAQ: MSFT) pair of in-memory databases run translytical workloads on its SQL Server.

“Contenders” in the emerging translytical sector include Splice Machine, GigaSpaces and NuoDB. Spice Machines OLAP platform was lauded for its ability to integrate a scale-out relational database management system with machine learning and streaming for predictive analytics applications.

GigaSpaces is credited with being among the first vendors to forge an in-memory data grid for Java that is widely used on Wall Street. Aptly names NuoDB is new to analytics, Forrester noted, but its distributed database provides “independent scale related to transaction processing and storage management,” the market researcher said.

Recent items:

In-Memory Database Goes ‘Translytical’

Aerospike Now Offers Strong Consistency With NoSQL Database