New Report Shows Stronger Profits for the (Few) Firms With Mature Analytics

Often, it can be difficult to assign numbers to the benefits afforded by intelligent use of corporate data. Now, a new report from Melbourne Business School and A.T. Kearney has highlighted the correlative relationship between analytics maturity and corporate profitability. The Analytics Impact Index – now in its second year – is produced based on a survey of (mostly) C-suite-level decision makers at over 350+ companies across nearly 50 countries and 27 industries. The result? The Value of Analytics in 2019, a report that aims to “[give] organizations a better understanding of the potential of analytics as well as the capabilities required to capture maximum value.”

Assessing Analytics Maturity

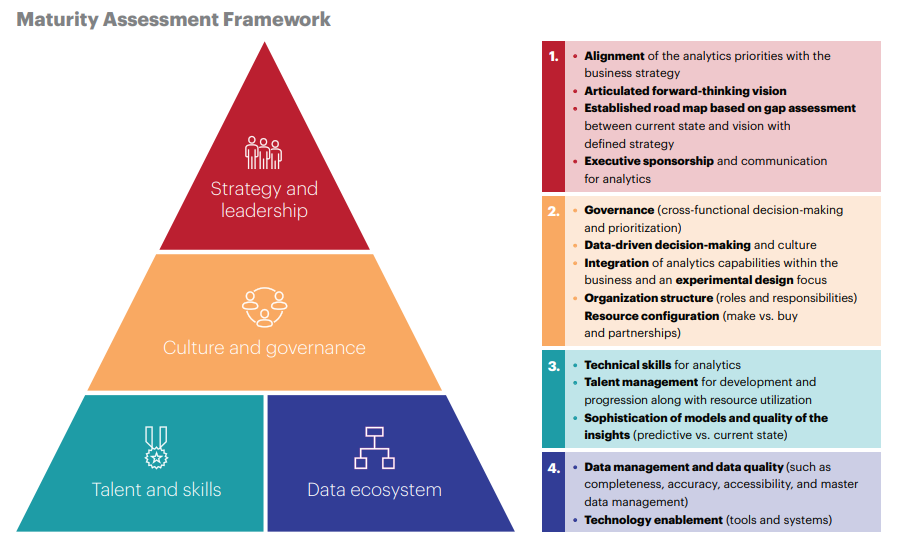

The researchers focused on two main metrics. First was analytics maturity. In assessing analytics maturity, researchers looked at:

Strategy and leadership. This looks at the company’s strategic direction for analytics and who within the company is driving it.

Culture and governance. This covers the operating structure and processes that are in place to support analytics along with the company’s general attitude toward analytics and analytics change management.

Talent and skills. This measures the human aspect of analytics, from recruiting the right people with the right skills to retaining, developing, rewarding, and using them effectively.

Data ecosystem. This relates to the technological infrastructure and data management framework that is in place to enable analytics, including developing and implementing architectures, policies, practices, and procedures to manage the company’s full data life-cycle requirements.

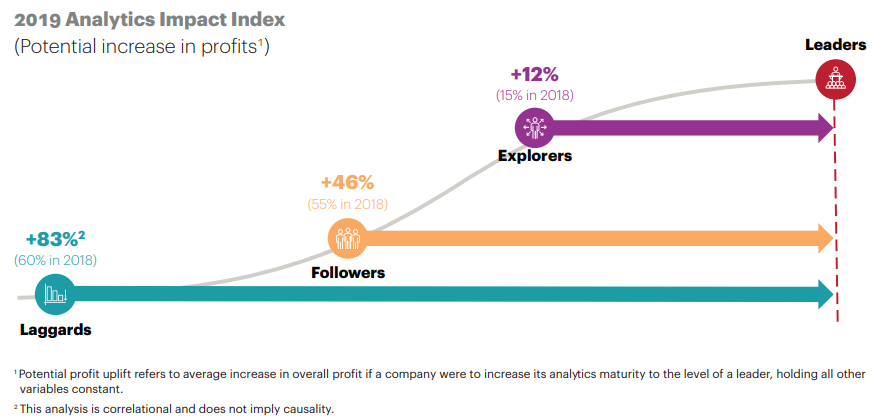

They found four main stages of analytics maturity among respondents. Laggards, or firms that only employed descriptive, retrospective data analysis and lacked a clear strategy, comprised 6%. Followers, or firms that used inferential modeling but did not use analytics to inform strategic decisions, comprised 37%. Explorers, or firms that used analytics to optimize performance by diagnosing drivers and predicting outcomes, comprised a whopping 49%.

But, sadly, leaders – which is to say, firms with “a C-suite commitment to analytics, a clearly defined analytics strategy that aligns with the overall business strategy, and a pervasive culture of data-driven decision-making” that used real-time analytics – constituted a meager 6% of respondents. The researchers noted that this is actually down 2% from the 2018 report.

Identifying the Financial Impacts

The second metric assessed by the researchers was the financial impact of analytics – that is, “the proportion of the organization’s profit that is attributable to analytics.” The researchers attempted to isolate the role of analytics by controlling for an array of factors (e.g. region, industry, size, previous profitability).

“Not surprisingly,” they wrote, “a higher level of maturity is associated with a greater financial impact from analytics.” While they note that diminishing returns were seen as analytics maturity deepened, they also highlighted the lower variance among returns for leaders (“perhaps,” they mused, “as a result of a sound analytics foundation established earlier on their analytics journey”).

While the authors noted that this relationship is correlative and not necessarily causative, they also stressed their view that analytics maturity and profit margins hold significant opportunities – especially for those low in the rankings. “Laggards stand to increase their overall profit by as much as 83 percent if they increase their analytics maturity to the level of a leader, holding all other variables equal,” they wrote.

The Future of the Index

The researchers are hopeful that as the Analytics Impact Index continues over the coming years, their insights will grow increasingly accurate and useful. “As the Index continues to grow,” the report reads, “it will provide a view of analytics’ effectiveness for a variety of industries and regions, how long it takes to progress from one stage of maturity to the next, and the focus areas and actions that can accelerate that evolution.”

The Analytics Impact Index survey is still open for the remainder of 2019. To take the survey, follow this link.