(TarikVision/Shutterstock)

The market for third-party data has exploded in recent years, giving companies an abundance of sources to choose from. That’s even more critical today in light of the demise of third-party cookies and Apple’s new privacy policy, which pummeled Facebook’s ads earnings. However, with thousands of data providers, the data buyer has little information to go on. That’s where a startup named Neutronian comes in.

The data buyer wonders: Is the data accurate? Was it obtained legally? Has it been secured? Does it comply with industry regulations? And above all, will it actually move the needle on my marketing campaign?

Neutronian was founded by data veterans from AWS and Comscore to answer these very questions. The Menlo Park, California company created the Neutronian Quality Index (NQI) to provide marketers with insight into the third-party data being sold on the open market (which is now often called first-party data, but more on that later).

“As a marketer, if you’re taking your most precious asset–light sweet crude–and you’re mixing that with lower quality crude oil, you should want to know about that,” says Neutronian CEO and co-founder Timur Yarnall. “We think there’s going to be a lot of interest and attraction there.”

Neutronian scours the Web to gather information about the data sellers and their products, which is reflected in the NQI. The data is ranked along five axes, including:

- Consent and compliance: Did users give the data gatherer consent? Does it comply with regulations like GDPR and CCPA?

- Sourcing transparency: Is it clear where the data originates from? Are you willing to put your brand’s reputation on the line for this?

- Dataset characteristics: Has the data been reviewed? Have basic data quality measures, like removing obviously invalid traffic, taken place?

- Methodology & Processing: How was it modeled and stored? Is it ready for consumption by data scientists? Is it secure?

- Performance: How does the dataset perform against a benchmark?

Yarnall compares Neutronian to the ratings services that Wall Street uses to help price equities. “Just like Moody’s, we’ll rate a bond offering, then we’ll sell analytics to a bond buyer,” he says. “What we do is we rate data sellers–and that’s a broad swath, with hundreds to thousands–and then we sell the results and the analytics to the marketer.”

Neutronian has two types of scores: one that’s public that’s done without the permission of the data sellers, and another more in-depth review that the data sellers pay for.

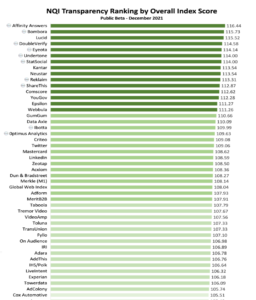

“Last month [December 2022] we published the first ranking of data providers out in the ecosystem. We call it Neutronian Transparency Ratings,” Yarnall says. “We rated 150 data providers. That was generally without their permission. We found everything we could about them publicly and scored that against the methodology.

“The next level we do is with the data provider’s cooperation or their request,” he continues. “We charge them a license fee for that certification or that audit. We’ve announced 10 to 12 certified providers so far, and many more are in the pipeline.”

With the demise of third-party cookies, companies are feeling the pinch to get more data to fuel their marketing operations. Apple’s decision to switch from an opt-out model for personal data disclosure to an opt-in model is also roiling the data market, as we saw with Facebook parent Meta’s shocking earnings miss, which sent its shares tumbling by 24% today.

A segment of the top-scoring data providers in the recent Neutronian Data Transparency Ratings (Source: Neutronian)

According to Yarnall, companies have two options: They can team up with the Web giants for marketing data, which works from a scale perspective but leaves companies at the whim of the Web giants. Or they can venture out on their own and forage for their own data.

“That’s the name of the game right now,” Yarnall says. “If you don’t want to be entirely dependent on Facebook, Google, and Amazon, you better take your first party data and you better mix and match with other high quality data. I think that’s important because there’s gradations of first-party data and there’s flavors of quality.”

Some very well-known data providers didn’t score particularly well on the Neutronian Transparency Ratings, which ranked about 150 data providers (which will soon be expanded to thousands, Yarnall says). 84.51, the Cincinnati-based data provider owned by Kroger, ranked ninth from last. Amazon Advertising, Nielsen, and Visa all were in the bottom quintile. Comscore and YouGov, by comparison, were near the top, along with Twitter, Mastercard, and Acxiom.

The Transparency Ratings reflect how difficult it was for the company to gain insight into how the data was gathered, Yarnall says.

“What we’ll do for example is we’ll score their consent mechanisms,” he says. “We’ll look at how easy their consent is to find or not find. We’ll look at their terms of service, privacy policies. We’ll also look at founder and executive experience. Obviously, Acxiom would have relevant experience. But as a consumer, how easily can I find the op-out mechanisms? We’ll score that.”

Some companies have ridiculously invasive opt-out mechanism. “Infutor requires a California resident to give a Social Security number to opt out of their data harvesting, which is just crazy,” Yarnell says. “I’m not talking about a subject access request. That’s a different story.”

The hope for data providers who sign up for Neutronian’s certification process is that a good data quality and transparency score will help it sell more data. The certification process also involves running the data through performance testing, which should give the data buyer an even better idea of what they’re buying.

“We’ll get a data sample, look at it in a match test, and check it for accuracy,” Yarnall says. “We’ll also have buy-side partner who will test the data in a campaign so they do an A-B test to see how it performs versus a comparable data provider or with no targeting.”

While the data at issue is, from a practical perspective, “third party” data, the industry has taken to calling it “first party” data now because it has the stamp of approval of the user, via the consent mechanism. That doesn’t change the fact that, when your company buys this data from third-party vendor, it is, from a practical perspective, third-party data.

Don’t let semantics fool you, Yarnall says.

“What we’re seeing is a strong shift to desire for ‘first party’ data,” he says (the quotation marks were his). “There’s not too many folks out there will ‘admit’ that they’re using third-party data. Everyone has shifted to saying we’ve only got first-party, consented data….I think the term third-party data now has almost become like a dirty word that nobody wants to use. So everyone is kind of changing the definition of what first-party data is.”

With hundreds of data sellers offering their products around the Web, the need for industry standards is only growing, Yarnall says. When data quality is more of a known quantity between the buyers and the sellers, it will only help grease the wheels for the free and open flow of data as a commodity.

“If you look at the New York Stock Exchange in the 1920s, it was very similar situation,” Yarnall says. “You had companies that were selling their stock. They didn’t even have to get audited financials. Who knew what you’re getting?”

There’s a direct parallel between the Roaring 20s of last century to what we’re going through today. “What we’re trying to be is like that GAAP [generally accepted accounting principles] audit standard, so that markets function with more trust and ultimately function more efficiently and it leads to growth for high quality data providers.”

Neutronian has published its methodology in a white paper and welcomes input. Yarnall , who co-founded MdotLabs, which was acquired by Comscore in 2014, welcomes an open debate on the topic.

“All my ideas and opinions are in a fully published white paper,” Yarnall says. “I do have very strong opinions. The passion for me in launching this company is I see a lot of bad data causing problems for companies. I see it causing problems for our democracy. I’m very passionate about it.”

Related Items:

What’s Holding Us Back Now? ‘It’s the Data, Stupid’

Data Integrity a Major Concern, Precisely Says

From First to Third, and Alternative Too: A Guide to Data Types

Editor’s note: The article was corrected. Infutor is the company that requires California residents to submit a Social Security number to opt out of data harvesting, not InFuture. Datanami regrets the error.

December 20, 2024

- Reltio Recognized as Best-of-Breed Representative Vendor in 2024 Gartner Market Guide for Master Data Management Solutions

- CapStorm Releases Salesforce Connector Offering Seamless Data Integration with Snowflake

- LogicMonitor and AppDirect Partner to Bring Hybrid Observability Solutions to IT Service Providers

- Patronus AI Launches Small, High-Performance Judge Model for Fast and Explainable AI Evaluations

- Equinix Unveils Private AI Solution with Dell and NVIDIA for Secure, Scalable AI Workloads

December 19, 2024

- Hydrolix Reports Technology Partner Ecosystem Momentum

- EQTY Lab, Intel, and NVIDIA Introduce Verifiable Compute AI Framework for Governed AI Workflows

- NeuroBlade Empowers Next-Gen Data Analytics on New Amazon Elastic Compute Cloud F2 Instances

- Quantum Announces Support for NVIDIA GPUDirect Storage with Myriad All-Flash File System

- Kurrent Charges Forward with $12M for Event-Native Data Platform

- Timescale Details PostgreSQL’s Growing Adoption Across Industries in 2024

- Altair Enhances RapidMiner with Graph-Powered AI Agent Framework

- Esri Releases 2024 Update of Ready-to-Use US Census Bureau Data for ArcGIS Users

December 18, 2024

- Qlik Shares 2025 AI and Data Trends: Authenticity, Applied Value, and Agents

- Domo Releases 12th Annual ‘Data Never Sleeps’ Report

- Dresner Advisory Services Publishes 2024 Embedded Business Intelligence Market Study

- Starburst Helps Arity Streamline Data Insights with Scalable Lakehouse Architecture

- Vultr Expands Global Reach with New Funding at $3.5B Valuation

- Ataccama Extends Generative AI Capabilities to Accelerate Enterprise Data Quality Initiatives

- Menlo Ventures Announces Cohort Backed by $100M Anthology Fund Launched in Partnership with Anthropic