Foundry Data & Analytics Study Reveals Investment, Challenges in Business Data Initiatives

Foundry has just released its 2022 Data & Analytics Study. The study contains insights into data-driven initiatives, investments, challenges, results and strategies of global businesses.

For the study, Foundry (formerly IDG Communications) surveyed 872 IT decision-makers in March and April 2022. Responses came in from companies across the world in many different industries including technology, manufacturing, financial services, professional services, healthcare, government, education and retail, with the average company employing 12,498 people. This is Foundry’s sixth Data & Analytics study, with the latest prior to this study being the 2021 IDG Data & Analytics Study.

Companies are Motivated to Extract Value From Existing Data

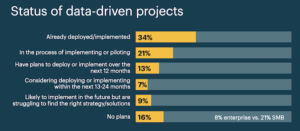

Foundry defines “data-driven initiatives” as projects undertaken in order to generate greater value from existing data, and 34% of surveyed organizations report having deployed such initiatives compared to 28% in 2021’s study. Enterprises are ahead of the game with 92% reporting data projects already in progress compared to only 79% of SMBs.

The motivation for extracting value from existing data varies across the sectors of business. Half of those surveyed aim to improve or automate internal business processes. Others have the goal of improving customer insight and engagement at 46%, along with customer service and support at 43%. An additional 43% seek to automate IT operations, while 36% wish to improve existing products. IT security improvements were also a motivating factor at 36%.

“Data and analytics tools continue to improve and the clear demand for these types of projects will continue to efficiently move these initiatives forward,” said Stacey Raap, marketing and research manager at Foundry. “These tools are providing businesses with invaluable insights, allowing them to increase performance and growth. We will likely see data and analytics tools in all parts of the business as they continue to advance.”

Data Initiatives Come With Challenges

Organizations are up against challenges with their data initiatives, and the major pain points the study uncovered include data quality at 41%, followed by data security and governance at 38%, data analysis at 31% and data preparation/transformation at 29%. In addition to these technical constraints, companies are also finding difficulty in skills training, as 44% of those surveyed named a lack of appropriate data skills as an issue, and 41% admitted the need for data analytics training for non-technical users within their organizations. Specialists in data architecture are also needed, as noted by 42% of respondents, mostly from enterprise-level businesses. Data analytics solutions remain inaccessible for 41% of organizations who say their technologies can only be used by skilled teams with specialized skills in data science, AI, and machine learning. Only 21% say their data solutions are available for use by all users, and 83% of respondents named focusing on self-service tools as a top priority.

Additionally, some companies have budget and strategy constraints that interfere with pursuing data projects, as reported by 16% of respondents. Twenty-one percent of organizations with over 1,000 employees noted that pandemic initiatives, such as enabling remote work, outranked data projects.

“As with any part of an organization’s growing technology stack, there are always challenges to overcome and IT teams and end users need to be given the correct resources to continue moving in a forward trajectory,” said Raap. “Organizations must invest to alleviate the pain points associated with data-driven tools and provide employees with the needed resources to refine their skillset.”

Spending on Data Tech to Stay Relevant

Despite difficulties, many companies are spending on various data analytics technologies to get an edge. Of those surveyed, 77% are investing in data in order to stay competitive in the marketplace. Foundry says that, on average, IT decision makers will spend $12.3M on data-driven initiatives over the next 12 months, and 55% expect their IT budget allocated to data-driven initiatives to increase in the next year, up from 44% in 2021.

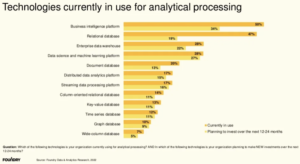

Half of the decision makers surveyed are currently using business intelligence platforms, followed by 34% who plan to invest in a BI platform within the next 2 years. Relational databases are also popular with 47% of respondents, followed by 28% who have invested in data science and machine learning platforms. Cloud-based enterprise data warehouses are also being used to run analytic workloads in the cloud and have already been adopted by 28% of those surveyed.

Deciding which vendors to engage with is another factor, as different vendors have distinct strengths and capabilities. In making these decisions, 36% of organizations named data reporting and visualization capabilities as the most vital criteria, followed up with security and governance capabilities and integration into existing infrastructure, both at 31%. Other criteria included the need for self-service analytics for non-technical users at 26%, along with the necessity for a data integration and transformation pipeline, also reported by 26%.

AI and machine learning technologies are also on decision makers’ radar, with 54% stating they have deployed or have plans to deploy predictive analytics in the next year. “[Predictive analytics’] use of historical data, statistical algorithms and machine learning techniques help organizations create a crystal ball-like best assessment of what will happen in the future,” the study’s executive summary stated. Machine learning is also used for anomaly detection in data by 31% of those surveyed, as well as descriptive analytics for customer analysis and natural language processing for virtual agents/chatbots at 29% and 28% respectively.

AI and machine learning technologies are also on decision makers’ radar, with 54% stating they have deployed or have plans to deploy predictive analytics in the next year. “[Predictive analytics’] use of historical data, statistical algorithms and machine learning techniques help organizations create a crystal ball-like best assessment of what will happen in the future,” the study’s executive summary stated. Machine learning is also used for anomaly detection in data by 31% of those surveyed, as well as descriptive analytics for customer analysis and natural language processing for virtual agents/chatbots at 29% and 28% respectively.

The study’s executive summary concludes by reiterating that even though companies are seeing challenges in deploying their data initiatives, the need to stay competitive in today’s post-pandemic market is driving the increased investment in data analytics.

“IT decision-makers are purchasing or looking into user-friendly business intelligence tools, cloud-based enterprise data warehouses and AI/ ML platforms that give them access to predictive analytics, anomaly detection, process automation and decision support,” stated Foundry’s conclusion.

To learn more, download the executive summary at this link.

Related Items:

Five Ways Big Data Projects Can Go Wrong (And What You Can Do About Them)

Cloud Is the New Center of Gravity for Data Warehousing

Big Growth Forecasted for Big Data